Understanding the American Rescue Plan Act of 2021

Presented by Lori Johndrow and Maggie Johndrow

On March 11, 2021, President Biden signed the American Rescue Plan Act of 2021 (“the Act”) into law, with large portions of the bill acting as an economic stimulus for individuals and businesses affected by the COVID-19 pandemic. At $1.9 trillion in total expenditures, the bill contains provisions pertaining to a variety of areas. This summary is intended to address only the critical provisions for individuals and small businesses.

Direct Payments to Individuals

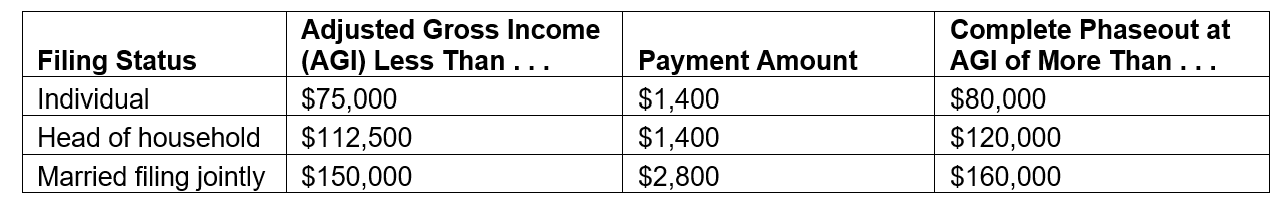

Much like the previous two coronavirus-related stimulus actions, individuals and families with incomes below certain thresholds can expect to receive a stimulus check (or direct deposit) from the government.

In addition, families will receive an extra $1,400 per dependent. The term “dependent” is an important change in this legislation, as previous stimulus funds were only applicable to taxpayers with children younger than 17. Accordingly, taxpayers with older dependent children, or other dependent family members living with them, will now see an enhanced payment amount.

Taxpayers with adjusted gross income (AGI) above established thresholds will see their eligibility for a payment phase out more quickly than under previous legislation. Regardless of the number of dependents, taxpayers with income that exceeds the upper phaseout threshold will not receive a payment at all. For those taxpayers within the phaseout range, their stimulus payment can be determined using the following formula:

(AGI – applicable threshold) / (upper phaseout threshold – applicable threshold)

For example, a married couple filing jointly with three dependents and an AGI of $155,000 would be eligible for a base stimulus of $7,000: $2800 + (3 * $1,400). They can calculate their reduction as follows: ($155,000 – $150,000) / ($160,000 – $150,000) = 50 percent of their base stimulus amount of $7,000, for a total stimulus of $3,500.

The determination of income will be based on taxpayers’ 2019 income tax return. If individuals would be entitled to a higher payment if 2020 AGI figures were used, they can file their return to claim eligibility to the higher payment. If a taxpayer receives a stimulus payment based on 2019 income and, thereafter, files a 2020 return with a lower AGI that entitles them to a higher payment, the government will use the 2020 AGI amount and supplement any payment already made based on 2019 income. To receive credit for a stimulus payment based on 2020 AGI, however, they must file their return by September 1, 2021, which is before the typical tax return filing deadline of October 15 for taxpayers who have requested an extension to the April 15 deadline.

A final opportunity for the maximum stimulus payment amount would come when taxpayers file their 2021 income tax return. If that return yields an AGI figure that entitles taxpayers to a higher amount than their 2019 or 2020 income did, they will receive a refundable tax credit equal to the increased stimulus payment amount eligibility.

The timing of the checks is not definitive, but government officials have expressed their intent to have payments sent as soon as administratively possible.

Expansion of Unemployment Benefits

Unemployed individuals, including those who typically aren’t otherwise entitled to unemployment compensation under state law (e.g., self-employed) and self-certify that they have been adversely affected by the COVID-19 pandemic, may receive unemployment compensation for an additional period of up until September 6, 2021.

In addition to any weekly unemployment compensation available under state law, unemployed individuals are entitled to an additional $300 per week for a period lasting until September 6, 2021, termed Federal Pandemic Unemployment Compensation.

The bill allows for up to $10,200 of unemployment income per individual to be tax free, subject to income limits. The stated income limit is an AGI of $150,000, which would include the sought-to-be-excluded unemployment income. The bill does not specify different income limits based on tax filing status (e.g., single, married filing jointly), and, therefore, it can be reasonably assumed that the AGI limit of $150,000 applies to all filing statuses. Additionally, the $150,000 AGI limit for unemployment income to be considered tax free is not a phaseout threshold; rather, it appears to be a “cliff,” meaning that if a taxpayer’s total AGI exceeds $150,000, they would not receive any tax-free treatment of benefits under the bill.

Loans to Distressed Small Businesses

The Paycheck Protection Program (PPP) will receive $7.25 billion in additional funding. Small businesses (defined as those employing 500 or fewer employees) will be eligible for forgivable, government-backed small business loans under the PPP. The same basic eligibility standards previously adopted for the PPP will remain applicable, and the window to request a loan will still close on March 31, 2021, unless otherwise extended.

The Act also provides funding to increase the accessibility of an Economic Injury Disaster Loan (EIDL) related to the COVID-19 crisis to the extent enough funding is available. Funds will be targeted from this program specifically to assist businesses with fewer than 10 employees and that suffered a substantial decrease in revenue.

A new Small Business Administration program designed to provide assistance to the disproportionately affected restaurant industry, called Restaurant Revitalization Grants, is funded in the Act. Similar to the PPP program, these tax-free Restaurant Revitalization Grants would be offered based on several conditions related to a loss of revenue due to the pandemic. Certain companies are excluded from eligibility for these loans, including restaurant chains with more than 20 locations and publicly traded companies. The first 21-day application period will be reserved for certain groups of owners (e.g., women-owned businesses, veterans).

Child Tax Credit

Many taxpayers will see an increase in their available child tax credit for the 2021 tax year from $2,000 per qualifying child to $3,000 per child age 6 and older and $3,600 per child younger than 6 as of December 31, 2021. Although the child tax credit is typically not subject to AGI limitations, the Act does put income limits in place for the enhanced credit amount over the typical $2,000.

If a taxpayer’s AGI exceeds the above-referenced threshold, the taxpayer’s eligible child tax credit over the typical amount of $2,000 would be reduced by $50 for every $1,000 of income over the threshold. For those taxpayers above the threshold, the amount of the credit can be calculated as follows:

Base amount – (the number of $1,000 increments the taxpayer is above the limit [e.g., 5 increments if they are $5,000 over the limit] * $50)

For example, a married couple filing jointly with a 4-year-old, a 7-year-old, and a 10-year-old and an AGI of $165,000 would be eligible for a base amount of $9,600 ($3,600 for the 4-year-old and $3,000 each for the 7-year-old and 10-year-old). Because they are $15,000 over the AGI limit, their credit can be calculated as follows: $9,600 – (15 * $50) = $8,850

Please note: The standard $2,000 credit is still subject to the typical phaseout of $50 for every $1,000 over the threshold of $400,000 for joint filers and $200,000 for single filers.

Taxpayers may receive an advance on their child tax credit in multiple installments beginning in July 2021. It is important to note that, unlike the direct stimulus payments, the advance of child tax credit amounts would need to be reconciled on the taxpayer’s 2021 tax return and could result in a liability for a return of any credit received that was in excess of their eligibility based on their 2021 tax return.

Additionally, the Child and Dependent Care tax credit, which provides tax credits for eligible childcare expenses incurred, will have expanded income eligibility and a higher potential credit amount during the 2021 tax year under the Act.

Another tax credit that has expanded eligibility under the Act is the Earned Income Credit (EIC). Individuals and couples without children, as well as younger individuals (as young as 19), could see access to a much higher EIC than was previously available.

Subsidized COBRA Benefits

Former employees who had their employment terminated and are eligible for an extension of their employee-sponsored health insurance under COBRA will not be responsible for health insurance premiums under COBRA from April until September 2021. Instead, those premiums will be paid by the former employer, and the employer will receive a refundable payroll tax credit. There will be a 60-day enrollment period for individuals to elect COBRA coverage, and eligibility for coverage would extend to individuals who lost their employment as far back as November 2019.

Student Loan Forgiveness

The Act also changes the treatment of student loan forgiveness to be nontaxable through 2025. In the past, President Biden has expressed a desire to forgive $10,000 in student loan indebtedness for each borrower, so experts theorize that this provision may be an anticipation of future executive and/or legislative action to forgive a portion of existing student loans.

Johndrow Wealth Management is located at 2 Bridgewater Road, Suite 101, Farmington, CT 06032, and can be reached at (860)-470-7424. This material has been provided for general informational purposes only and does not constitute either tax or legal advice. Although we go to great lengths to make sure our information is accurate and useful, we recommend you consult a tax preparer, professional tax advisor, or lawyer. Securities and advisory services offered through Commonwealth Financial Network, member FINRA/SIPC, a registered investment adviser.

© 2021 Commonwealth Financial Network®